Climate Insider Brief:

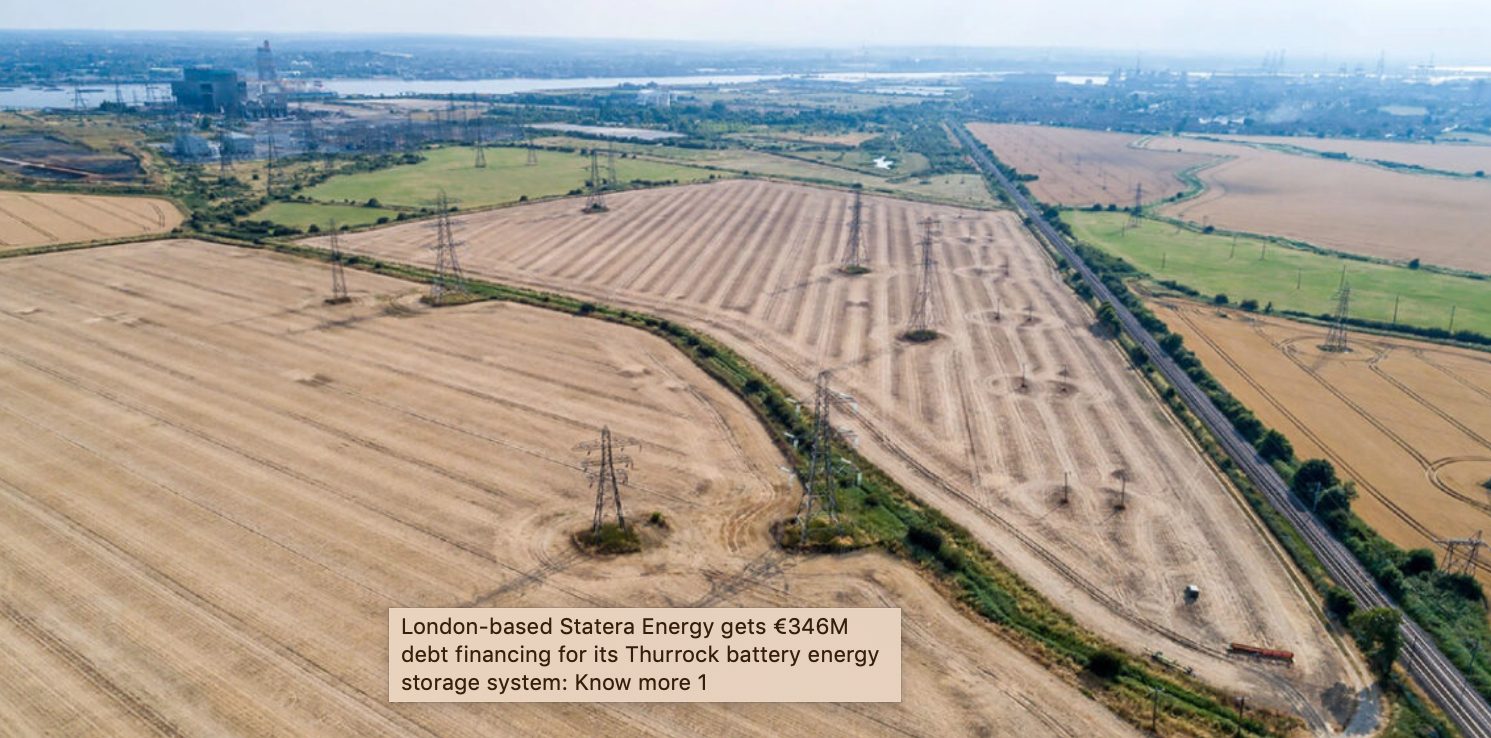

- London-based Statera Energy, a developer and operator of energy storage and flexible generation projects, has announced the successful securing of up to £300M in debt financing through a syndicate led by Lloyds Bank.

- The initial £144M of the financing will support Statera’s Thurrock Battery Energy Storage System (BESS), providing the UK with an additional 300MW (600MWh) of flexible storage capacity.

- The remaining funds will contribute to the development of a 270MW flexible generation plant, which has already secured a capacity market contract.

PRESS RELEASE – November 27, 2023 – London-based Statera Energy, an energy storage and flexible generation developer and operator, announced recently that it has secured up to £300M (approximately €346M) of debt financing through a syndicate led by Lloyds Bank.

Managing Director, Head of Infrastructure and Project Finance at Lloyds Bank, James Taylor, says, “By storing excess energy, Statera’s technology ensures the UK’s increasingly renewables-led power system can deliver all day and all year round, promoting security and stability, reducing carbon emissions and, ultimately, helping to lower people’s energy bills. The financing we’ve arranged will provide a platform for Statera to continue to develop its portfolio of assets across the UK. We’re excited to see what the team achieves next and to support more businesses and infrastructure projects leading the UK’s renewable energy transition.”

The initial £144M (approximately €166M) will fund Statera’s Thurrock Battery Energy Storage System (BESS), providing the UK with an additional 300MW (600MWh) of flexible storage capacity.

The balance will fund the development of a 270MW flexible generation plant, which secured a capacity market contract early this year.

The BESS project

Located near Greater London, the BESS project is the first stage of Statera’s wider Thurrock development plans to enter construction.

Statera Energy has already secured consent for 900MW of energy storage and flexible generation assets at the site, classified by the UK Government as a ‘Nationally Significant Infrastructure Project’.

Once commissioned, the 300MW BESS project will be one of the largest in the UK and Europe.

The announcement comes after Statera Energy secured financing for the Thurrock BESS project from Swedish Private Equity firm EQT Infrastructure and is now moving towards its next growth phase.

It plans to develop a project pipeline of over 16GW, of which 7.5GW is expected to become operational by 2030.

Statera Energy: Providing critical grid balancing support

Founded by Tom Vernon in 2015, Statera Energy is an energy company that develops, owns, and operates flexible generation, battery storage, pumped hydro, and green hydrogen projects.

These assets will help the UK build more renewable energy quickly by providing the flexible capacity needed to balance the future grid, whilst lowering carbon emissions and delivering the best value for energy users.

Statera’s CEO and founder, Vernon says, “Lloyds’ commitment to Statera, through one of the largest battery storage debt financing deals in the UK to date, is a testament to the quality of our projects. Our Thurrock BESS project is strategically located near Greater London, providing further energy system resilience to this key demand center. System flexibility in the form of energy storage technologies is a crucial part of achieving energy security, decarbonising our power system, and enabling the UK’s transition towards net zero. We are delighted to have worked with Lloyds, the syndicate of lenders, and Statkraft in achieving this significant milestone.”

To stay informed about the climate industry explore our latest climate tech news.

SOURCE: Silicon Canals

Featured Image: Credit: Statera Energy