Climate Insider Brief:

- World Fund, based in Berlin, is allocating €300 million towards supporting climate tech founders in Europe over the next few years.

- This initiative represents the largest dedicated pool of funds for climate-focused startups on the continent.

- The fund aims to make 25-30 investments in European startups that are developing technologies with the potential to decarbonize entire industries.

PRESS RELEASE – March 22, 2024 – Berlin-based World Fund will provide €300M to climate tech founders over the next few years, making its fund the largest climate-dedicated pool the continent has seen yet. The commitment marks a first foray into climate investing for many LPs, signalling strong belief in the sector’s resilience despite the continuing VC hesitancy that stems from geopolitical and economic crises.

The fund will make 25-30 investments into European startups building technologies ‘with the potential to decarbonise entire industries’. Previous recipients included ENOUGH Food, which ferments fungi to create meat substitutes, Space Forge‘s in-space production of computer chips and Customcells’ silicon-based batteries.

World Fund states that a ‘significant’ priority is to help startups overcome the Series B ‘Valley of Death’ uniquely associated with the energy sector; a new report by Startup Coalition states that ‘the point at which a firm transitions from proving a concept to entering a commercial market is a near-universal barrier’.

A newly established sector, climate tech’s commercial and regulatory norms are still being drawn up and this funding gap often comes down to the challenges typical of realising ‘first of its kind’ technologies. Many hope to see governments step in to help these products get to market by streamlining regulatory requirements, investing with expectations of long-term returns and co-ordinating with the sector on exports.

World Fund looks to assist in bridging the gap by leading financing rounds and reserving capital for follow-on investments for companies in its portfolio. Erste Plavi’s Petar Vlaić explained why the company evoked such confidence from investors: “The Fund’s team members have a strong track record in climate tech investing, and have extensive experience in the industry and a deep network within the European tech ecosystem.”

Notable backing for the fund comes from EIF, KfW Capital, Wachstumsfonds, BPI France, PwC Germany, NRWbank and Ignitis Group as well as its first investor, independent search engine Ecosia. A number of pension funds also joined the fund.

Danijel Višević, Managing Partner at World Fund, said:

“Our planet is at a pivotal juncture, and we could not be prouder to spend every day working towards creating a regenerative world, backing European founders building world-changing companies. If you’re building something, please contact us – our doors and inboxes are always open.”

To stay informed about the climate industry explore our latest climate tech news.

SOURCE: Tech.eu

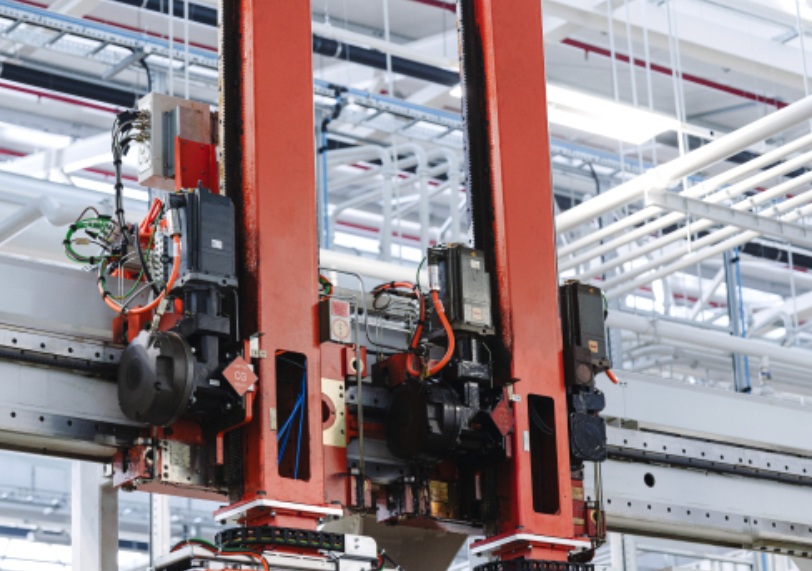

Featured Image: Credit: World Fund