Climate Insider Brief:

- Google Ventures led a £14m ($18m) investment in Climate X, a London-based startup specializing in climate risk tools for financial institutions, to support its expansion into the US market.

- Additional investors included Pale Blue Dot, Blue Wire Capital, PT1, Unconventional Ventures, Western Technology Investment (WTI), CommerzVentures, and A/O PropTech.

- Climate X uses digital twins and extensive data modeling to assess climate risks to real-world assets.

Google Ventures has led an £14m ($18m) investment into London-based startup Climate X, aimed at facilitating the company’s expansion into the US market. Climate X, which specializes in providing tools for financial institutions and asset managers to monitor climate risk to their physical portfolios, has attracted additional funding for the Series A round from Pale Blue Dot, Blue Wire Capital, PT1, Unconventional Ventures, and Western Technology Investment (WTI).

CommerzVentures and A/O PropTech, previous investors in Climate X’s £4.1m seed funding round in 2022, also participated in this latest round. Climate X is now poised to expand further in Europe, North America, and Asia Pacific, beginning with the establishment of a commercial team at its newly opened office in New York.

Paul Morgenthaler, Managing Partner at CommerzVentures, highlighted the increasing physical risks to properties due to escalating climate impacts such as floods, heatwaves, and wildfires. He noted that real estate, as the world’s largest asset class, is increasingly being mispriced due to these risks.

Climate X’s platform utilizes digital twins of real-world assets and models the climate risk to them based on “500 trillion data points.” Since its founding in 2020 by Lukky Ahmed and Kamil Kluza, the company has secured prominent clients including Legal & General, BRE, and Virgin Money.

“The climate adaptation market will be a vital economic enabler in the years ahead, yet to date, it has been dominated by expensive consultancies reliant on manual human analysis and black box solutions that reduce climate risk to a single rating or score,” said Kluza, COO of Climate X. “We’re breaking the mould with technology designed to drive business value by helping our clients answer critical questions about their asset portfolios and investment strategies: where to buy, where to sell, how to build portfolio resistance, reduce insurance premiums and protect asset values.”

Climate X faces competition in the climate intelligence market, although one of its competitors, Cervest, collapsed earlier this year.

Implications

The £14m funding round for Climate X signifies a notable development in the climate tech landscape, particularly in the US. The investment, led by Google Ventures, underscores the growing recognition of the importance of climate risk management tools for financial institutions and asset managers. As Climate X expands its presence in North America, it is likely to drive increased adoption of advanced climate risk analytics, promoting more resilient investment and asset management strategies.

The participation of a diverse group of investors highlights a broad interest in supporting innovative solutions to climate risk, suggesting a robust future for the climate adaptation market. With its advanced technology and expanding footprint, Climate X is well-positioned to influence the direction of climate risk management practices, potentially setting new standards for how physical climate risks are assessed and mitigated.

News Source: UK Tech News

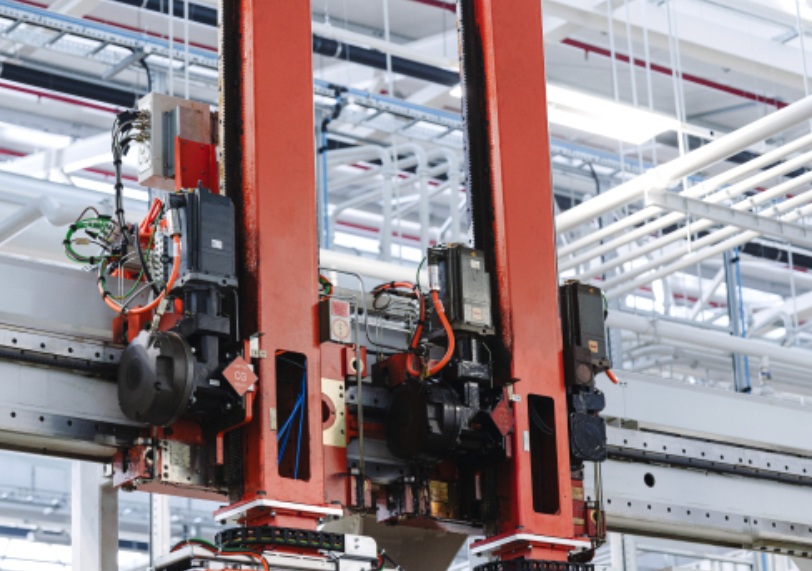

Featured Image: Credit: Climate X