Author: Dwayne Pattison

Climate Insider presents our next market map for climate technologies, focusing on hydrogen. This versatile element has been mentioned in almost every map we’ve compiled, warranting its own dedicated analysis to better cover the key technologies. Hydrogen offers solutions across a spectrum of industries, from energy production to transportation. In this map, we delve into the critical technologies of the hydrogen economy, structured around the core segments of production, storage, utilization, and systems integration.

1. Hydrogen Production

Hydrogen production focuses on generating hydrogen sustainably and cost-effectively. The main technologies include:

- Electrolysis (Water Splitting): This process uses electricity—ideally from renewable sources—to split water into hydrogen and oxygen. It’s considered one of the most promising paths towards green hydrogen. Currently, Proton Exchange Membrane (PEM) and Alkaline electrolyzers are the leading technologies.

- Steam Methane Reforming (SMR): This is presently the most common method, producing hydrogen from natural gas. It results in carbon emissions unless combined with carbon capture and storage (CCS).

- Biomass Gasification: This method converts organic materials into hydrogen, carbon dioxide, and carbon monoxide through high-temperature processing.

- Photo-biological and Photo-electrochemical Processes: These techniques use sunlight to produce hydrogen directly from water or biomass. Both are still largely in the research and development stages.

Check out the Climate Insider’s recent article on some of these green hydrogen producers – Top Green Hydrogen Companies

2. Hydrogen Storage and Distribution

This sector focuses on technologies for storing and transporting hydrogen, which presents challenges due to its low density and high reactivity.

- Physical Storage: Compressing hydrogen in gas cylinders or liquefying it at cryogenic temperatures.

- Material-based Storage: Using materials like metal hydrides or chemical carriers that can absorb and release hydrogen. Liquid organic hydrogen carriers (LOHCs) are a promising group of technologies in this category.

- Pipeline Transportation: Developing infrastructure to transport hydrogen through pipelines, similar to natural gas networks.

Companies in this sector are developing robust containers and improving hydrogen transport logistics.

Two other notable chemical carriers for storing and distributing hydrogen are ammonia and methanol. These chemicals are significant in the hydrogen discussion for several reasons:

- Infrastructure: A global infrastructure for ammonia production, storage, and transportation already exists, primarily for fertilizer production. This infrastructure can be adapted for energy purposes.

- Ease of Transport: Ammonia can be liquefied under mild pressure or refrigeration, making it easier to store and transport than gaseous hydrogen. Methanol is a liquid at ambient conditions, simplifying its transport and storage.

- Applications: Ammonia can be used as a fuel itself (particularly in industrial processes or power generation) or broken down into nitrogen and hydrogen for use in fuel cells or other applications requiring pure hydrogen. Methanol is especially useful in sectors where electrification is challenging, such as maritime transport. It can also be reformed to release hydrogen on-site, beneficial in locations where local hydrogen generation is necessary.

3. Hydrogen Utilization

Hydrogen utilization encompasses various end-use and process-oriented applications:

- Fuel Cells: Converting hydrogen into electricity, producing only water as a byproduct. These are used in vehicles and stationary power systems.

- Industrial Processes: Employing hydrogen as a feedstock in chemical processes, such as ammonia production, or as a reducing agent in steel manufacturing.

- Power Generation: Burning hydrogen in turbines to generate electricity, or using it in hybrid systems alongside other fuels.

Vehicle manufacturers and energy companies are key stakeholders, driving advancements in fuel cell technologies and their integration into mainstream applications.

4. Hydrogen Systems and Integration

This area focuses on integrating hydrogen technologies into existing energy systems to enhance efficiency and sustainability.

- Sector Coupling: Linking hydrogen production with other energy-consuming sectors such as electricity, heating, and transportation.

- Grid Balancing and Power-to-Gas Systems: Using hydrogen as a storage medium to balance fluctuations in the power grid caused by variable renewable energy sources.

- Decentralized Production and Usage: Developing systems that can produce and use hydrogen at the point of need, reducing the need for extensive transport or storage infrastructure.

Startups are developing solutions that integrate hydrogen into broader energy systems, enhancing the flexibility and resilience of energy infrastructures. Consultancies and system developers play a crucial role in designing these integrative approaches, ensuring hydrogen’s place in a holistic energy model.

As hydrogen technologies evolve, they play a vital role in creating a diversified and sustainable energy future. Both startups and established companies are pushing the boundaries of what’s possible, driven by the global imperative to reduce carbon emissions and transition to cleaner energy solutions.

Further Reading and Resources

Research

Recent hydrogen research covered by Climate Insider:

- Unique Material Shows Potential to Produce Green Hydrogen

- Efficient and Safe Hydrogen Energy Production Method Developed by Swedish Scientists

- Water Electrolysis Catalyst Developed by Researchers at Pohang University: Efficient Hydrogen Production

- Sandia National Laboratories Research subterranean storage of hydrogen

CI Market Maps

Be sure to check out the other Climate Insider Market Maps in our series:

- Overview

- Food and Agriculture

- Energy

- Transportation

- The Built Environment

- Industry

- Carbon Management

Soon to come – waste management. Stay tuned.

Our list of companies

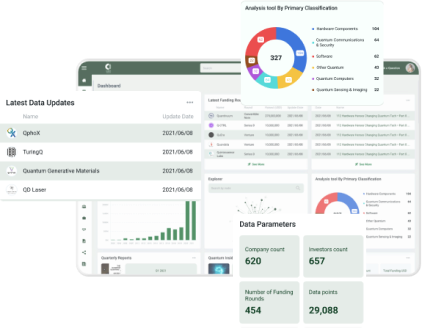

As we note in all our market overviews, the map is just a snapshot of the activity today and only covers a small number of the companies working in the industry. We have tried to select a range of companies – the new and the more established, recently funded or no funding, those with only a few employees to those with hundreds.

Hydrogen is a dynamic and rapidly changing industry with companies operating throughout the value chain. As such, we look to update this a few months down the road and see what has changed.

Some of the companies on the map:

Aatral Hydrogen

AFC Energy

Airbus

Amogy

Aurora Hydrogen

Ayrton Energy

Azolla Hydrogen

Ballard Power Systems

Bayotech Hydrogen

Carbon 280

Ceres

Clean Power Hydrogen

C-Zero

ecolectro

Elcogen

Electric Hydrogen

Elogen

Enapter

EO-Dev

Ergosup

EvolOH

Fly-Box

FTXT Energy Technology

Fuel Cell Energy

Fuel Cell Systems

FuelCell Energy

Gen2 Energy

GKN Hydrogen

Green Hydrogen

Greenko Group

H2 Core Systems

H2 Green Steel

H2APEX

H2Pro

HDF Energy

Helinor Energy

Helion Hydrogen Power

Henan Nowogen

Hexagon Purus

HiiROC

Holthausen Clean Technology

Hopium

Horizon Fuel Cell

HSL Technologies

H-TEC Systems

Hy2gen

Hydgenfuel

HydroGain

Hydrogen Energy

Hydrogen in Motion

Hydrogen Optimized

Hydrogen Refuelling Stations

Hydrogenious

HydrogenPro

Hydrolite

Hyfindr

Hyfluence

Hygenco

Hygreen Energy

Hynion

Hypion

Hyrex AS

Hysata

Hyvia

Hyzon

Immaterial

Innova

ITM Power PLC

Kaizen Clean Energy

Keyou

Kontak Hydrogen Storage

Lavo

Lyfe

Maximator Hydrogen

McPhy

Monolith

NamX

Nel Hydrogen

Neology

New Wave Hydrogren

Next Hydrogen

NPROXX

Nuvera Fuel Cells

Ohmium

Oort Energy

Peregrine Hydrogen

Plagazi

Plug Power

PowiDian

Provaris Energy

Quantron

Refire

Resato Hydrogen Technology

Ryze Hydrogen

Shanghai Hydrogen Propulsion Technology

Stargate Hydrogen

Steelhead Composites

Sunfire

Sungreen H2

SunHydroegn

Symbio

Teco 2030

Titan Hydrogen

Verdagy

Voyex

Xydrogen

ZEG Power

ZeroAvia