Welcome to Climate Tech Pulse, your daily dose of market intelligence helping fuel the fight against climate change. From groundbreaking investments to cutting-edge research, we’re bringing you the latest in climate tech that’s shaping our future.

Don’t miss out on tomorrow’s climate solutions – subscribe now to stay ahead of the curve! https://lnkd.in/dwr7B9XJ

Today’s newsletter:

Canada’s Big Bet on Critical Minerals and a Greener Future!

Boosting Rare Earth Processing in Saskatchewan

Saskatchewan Research Council (SRC) is expanding its rare earth processing facility in Saskatoon with over $16 million in government funding. This is another step towards improving the security of Canada’s energy supply chains by ensuring that the country’s resources not only stay in Canada, but are processed here.

Government Backing and Indigenous Training

The Canadian government is investing in SRC to create jobs and secure a domestic rare earth supply chain. The initiative includes training Indigenous students in rare earth processing, supporting sustainable economic growth.

Strengthening Canada’s Critical Minerals Sector

Canada is bolstering its position as a global leader in critical minerals, vital for clean energy and national security. The government’s Critical Minerals Strategy, backed by a $4 billion investment, leverages Canada’s existing strengths in mineral production. As a major producer of nickel, potash, aluminium, and uranium, Canada is well-positioned for growth in the critical minerals sector.

The Saskatchewan Research Council (SRC) will acquire Canadian bastnaesite ore to produce rare earth metals as part of this strategy, supported by new geoscience data. This enhances Canada’s domestic production and global position in the rare earth elements supply chain. By developing critical minerals, Canada strengthens its role in providing essential materials for clean energy technologies while protecting national security interests in a competitive global market. Read More

Quote of the Day

“The funding announced by PrairiesCan means SRC will be able to expand its current Rare Earth Processing Facility to process a wider range of rare earth minerals – developing additional capacity and knowledge within Canada for this burgeoning industry. SRC’s Rare Earth Processing Facility will soon be operational, making the province a domestic rare earth technology hub and an essential part of Canada’s critical minerals supply chain.”

–Mike Crabtree, President and CEO, Saskatchewan Research Council

Significance: Mike Crabtree highlights that the funding will allow Saskatchewan to become a central hub for rare earth processing in Canada, strengthening the country’s critical minerals supply chain.

Market Movers

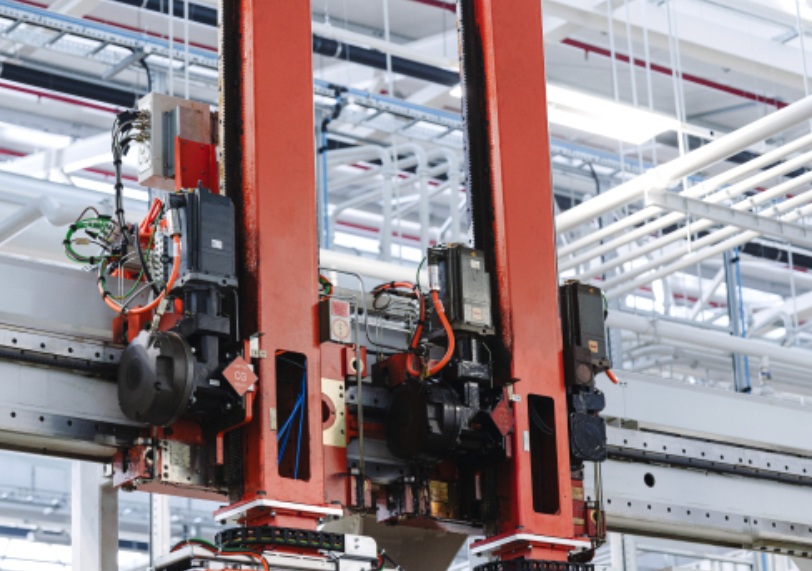

Image Credit: General Motors

This section highlights key investments and initiatives driving progress in sustainability and climate innovation.

- CCEP Ventures has invested in Pipeline Organics to scale technology that converts wastewater into renewable electricity, enhancing Coca-Cola’s sustainability efforts and energy resilience across its manufacturing sites. Read More

- Investible’s Climate Tech Fund has backed DeCarice, a cleantech startup developing hydrogen-diesel dual-fuel technology that can reduce emissions by up to 85%, offering a scalable solution for decarbonizing heavy-duty industries like mining and transportation. Read More

- Tom Steyer’s Galvanize Climate Solutions is raising funds to launch a lending operation that will provide loans to mid-sized companies and projects supporting the green transition, leveraging its expertise in climate technology to simplify financing for clean energy initiatives. Read More

- The Scottish Government and Storegga are jointly investing £6.2 million to develop a green hydrogen hub in Speyside, expected to produce 200MW of green hydrogen by 2032, significantly reducing carbon emissions in the Scottish whisky industry and aiding the region’s energy transition. Read More

- Prumo Logística and Fuella have secured a contract to reserve land for a new low-carbon hydrogen hub at the Port of Açu in Rio de Janeiro, aiming to produce and export green hydrogen, ammonia, and methanol, with production expected by 2030, marking a significant step in Brazil’s renewable energy expansion. Read More

- GM has signed its largest renewable energy deal with NorthStar Clean Energy to power three assembly plants, advancing its goal to be carbon neutral by 2040 and reinforcing its position as the automotive industry’s largest buyer of renewable power. Read More

Tech Spotlight

Image Credit: Chalmers University of Technology

Chalmers Researchers Develop New Method to Improve Fuel Cell Longevity

Researchers at Chalmers University of Technology in Sweden have developed an innovative method to study and understand how fuel cells degrade over time. This breakthrough marks a significant step toward enhancing fuel cell performance and extending their lifespan—crucial factors for their commercial success in heavy-duty hydrogen vehicles.

This method, which tracks specific particles within the fuel cell during use, offers valuable insights into material degradation, paving the way for the development of more durable and efficient fuel cells.

When applied to fuel cell research and development, this method promises to offer a range of advantages over traditional analytical approaches:

Commercial Viability

- Extended Lifespan: The new method provides critical data needed to design fuel cells that can withstand the 20,000 to 30,000 hours of operation required for heavy-duty vehicles.

- Market Potential: Improved fuel cells could make hydrogen-powered trucks more competitive against combustion-engine vehicles, especially in sectors like logistics and transportation.

Technical Viability

- Enhanced Understanding: The method allows researchers to pinpoint when and where degradation occurs within the fuel cell, offering unprecedented detail at the nano and micro levels.

- Scalability: The method is applicable to a range of fuel cell designs and can be integrated into ongoing R&D efforts to improve existing technologies.

Environmental Viability

- Cleaner Energy: Fuel cells powered by hydrogen produced from renewable energy sources emit only water vapour, making them a sustainable alternative to fossil fuels.

- Resource Efficiency: By extending the life of fuel cells, the method contributes to more efficient use of materials and resources, aligning with global sustainability goals.

With an eye towards the future, this innovation offers a promising tool for advancing the commercial viability of fuel cells while reducing the upfront barriers impeding the broader adoption of hydrogen as a clean energy source. Read More

Policy Pulse

This section includes global updates on climate change policy, governance and regulation.

The Governments of Canada and Ontario announced a $64 million investment over four years to enhance Ontario’s wildfire response capabilities.

This funding aims to better prepare Ontario to respond to wildfires by upgrading equipment, hiring more personnel, and enhancing safety for communities and firefighters, with an emphasis on resource sharing across Canada.

Why it Matters: The federal and provincial governments are working together with communities, Indigenous groups, and international allies to address and mitigate the impacts of wildfires, emphasising public safety and the protection of lives and livelihoods. Read More

The UK government plans to introduce legislation to regulate ESG ratings providers in 2025.

The UK government will introduce legislation in 2025 to regulate ESG ratings providers, placing them under the Financial Conduct Authority’s oversight to enhance transparency and reliability in response to growing demand and concerns about inconsistent ratings and conflicts of interest.

Why it Matters: UK government’s plans to introduce legislation to regulate ESG ratings providers matters because it addresses the need for greater transparency and consistency in ESG ratings, which are crucial for investors seeking reliable data to make decisions around sustainable investment. Read More

Today’s Climate Data Point

U.S. Emerges as Global Leader in EV and Battery Manufacturing

Image Credit: Morningstar

Under President Biden’s administration, the U.S. has witnessed an unprecedented surge in investments in the electric vehicle (EV) sector, totaling $312 billion. This influx of capital, more than double the $75 billion at the start of Biden’s term, has positioned America as the leading global hub for EV production and battery manufacturing.

This investment boom, driven by the Inflation Reduction Act (IRA), and other supportive policies, marks a significant shift in the global EV landscape, with the U.S. now commanding roughly 25% of all announced global EV investments.

To help understand the impact of these investments, here’s a breakdown of key data points:

Investment Growth:

- Total Commitments: $312 billion invested in the U.S. EV sector, up from $75 billion at the beginning of Biden’s presidency.

- Battery Manufacturing: $133 billion allocated specifically for battery manufacturing and recycling.

Regional Dynamics:

- State Impact: Nearly 484 active or planned EV-related facilities across 40 states, with Georgia, Michigan, and Tennessee emerging as key hubs.

- Job Creation: The IRA has contributed to the creation of nearly 313,000 jobs since its passage, many in traditionally Republican-controlled districts.

Legislative Influence:

- Inflation Reduction Act (IRA): The IRA has been a catalyst for this investment surge, highlighting the importance of long-term regulatory stability in sustaining momentum.

- Clean Vehicle Tax Credit: Up to $7,500 for new EVs, driving consumer adoption and boosting the market.

Global Positioning:

- Market Leadership: The U.S. leads in global EV investments, surpassing China and other competitors.

- Domestic Production: The U.S. is revitalizing its role as a key player in lithium-ion battery technology, with plans to produce over 11 million EVs annually.

This data illustrates the profound impact of recent policies on the U.S. EV industry, fostering economic growth, job creation, and positioning the country as a leader in the global transition to clean transportation. Read More

In Other News

This section covers notable news highlights in climate tech.

- Antler, an early-stage venture capital firm based in Singapore, has successfully closed its second Southeast Asia-focused fund, Antler SEA Fund II, raising $72 million. Read More

- Swedish grid startup Flower has raised a 290m SEK (€25m) Series A, according to documents in Bolagsverket, the Swedish company’s house. Read More

- Nottingham-based startup Promethean Particles has secured an £8m Series A investment to scale manufacturing of its advanced materials for carbon capture. Read More

- Blockchain firm Verofax has teamed up with climate tech startup Netgreen to enhance global reforestation efforts. Read More

Climate Insider Intelligence: Deep Dive on Net Zero Asset Managers Initiative’s Target Disclosures Report 2024

Image Credit: Net Zero Asset Managers Initiative

The Net Zero Asset Managers (NZAM) Target Disclosures Report 2024 reveals a powerful shift in how asset managers are tackling climate change. With 264 signatories setting net-zero targets, the financial sector is not just adapting—it’s driving the transition to a sustainable future.

Key takeaways include:

- Significant Scale: The sheer number of signatories could spark a domino effect, pushing the entire industry towards climate action.

- Urgent Action: A whopping 98% of these asset managers have set interim targets for 2030 or sooner, showing a serious commitment to quick and impactful change.

- Global Impact: With signatories from over 35 countries, the movement is truly international, though some regions still lag behind.

Challenges include implementing these ambitious targets, navigating shifting regulations, and managing technological demands. But the report makes one thing clear: asset managers are central to reshaping the financial world for a net-zero future, opening new opportunities and posing new questions about the global impact of this transition.