Welcome to Climate Tech Pulse, your daily dose of market intelligence helping fuel the fight against climate change. From groundbreaking investments to cutting-edge research, we’re bringing you the latest in climate tech that’s shaping our future.

Don’t miss out on tomorrow’s climate solutions – subscribe now to stay ahead of the curve! https://lnkd.in/dwr7B9XJ

Today’s newsletter:

🔝Today’s Top Story: Elemental Impact, previously Elemental Excelerator, is now accepting applications for a $100M funding initiative through the U.S. EPA’s Greenhouse Gas Reduction Fund (GGRF).

📊 Today’s Data Point: Emerging Viability and Challenges of Carbon Removals.

🌳 Climate Insider Intelligence: The Rise in Net Zero Commitments Among Global Giants – Insights from the Climate Impact Partners Report.

Elemental Impact Launches $100M Fund to Scale Climate Tech Solutions Nationwide

Image Credit: Elemental Impact

New $100M Greenhouse Gas Reduction Fund

Elemental Impact, formerly known as Elemental Excelerator, has announced the opening of applications for a $100M funding program under the U.S. Environmental Protection Agency’s Greenhouse Gas Reduction Fund (GGRF). This funding, secured through a subaward from the Coalition for Green Capital, is aimed at supporting entrepreneurs and climate technologies poised for scale. The initiative seeks to drive significant greenhouse gas reductions and deliver benefits to local communities by investing in scalable, impactful projects across various sectors, including energy, transportation, and agriculture.

Elemental Impact’s Strategic Expansion

As part of its strategic growth, Elemental Excelerator has rebranded to Elemental Impact, reflecting its evolution into a comprehensive investing platform. This platform includes a family of funds, such as the $94M Earthshot Ventures, and is backed by $210M in philanthropy and public funding. With its expanded focus, Elemental Impact aims to mobilize capital from diverse sources—philanthropy, government, and private investors—while continuing to provide tailored support to climate entrepreneurs and communities through initiatives like the GGRF funding program.

Collaboration and Community-Focused Investments

Elemental Impact will play a pivotal role in the nationwide deployment of GGRF, collaborating with multiple partners, including Climate United and Power Forward Communities. The organization will leverage its extensive network of over 1,000 co-investors to amplify the $100M in funding, aligning with the U.S. EPA’s goal of mobilizing private capital for green infrastructure projects. By fostering scalable, community-focused climate solutions, Elemental Impact is set to drive transformative change in historically underserved areas, supporting both environmental and social progress. Read More

Quote of the Day

“We have invested in more than 150 companies working to scale important innovations, and the challenge is clear. The sector needs not only innovation in technology, but also in finance, community partnership, and project implementation. Today, we are expanding our platform to meet this need – because where we invest our time and our capital over the next five years will impact the next hundred.”

– Dawn Lippert, founder and CEO of Elemental Impact.

Significance: The quote highlights Elemental Impact’s broader vision of not just advancing technological innovation but also addressing gaps in finance, community partnerships, and project implementation—key elements for successful climate solutions.

Long-Term Impact: The quote underscores the importance of strategic investments today, with the understanding that these decisions will have a ripple effect on climate action for the next century, emphasizing the long-term commitment of Elemental Impact.

Platform Expansion: It serves as a justification for the expansion of Elemental Impact’s platform, which now includes multiple funds and a more comprehensive approach to mobilizing capital from various sources to drive significant environmental and community impact.

Past Success: By referencing their investment in over 150 companies, the quote establishes credibility and experience, reinforcing the organization’s capability to lead in scaling impactful climate technologies and projects.

Market Movers

- AIR COMPANY, a carbon conversion tech firm, secured $69M in Series B funding led by Avfuel to advance emissions-reducing technologies for hard-to-abate sectors like aviation, with key industry players participating to support energy security and environmental tracking initiatives. Read More

- Leonid Capital Partners provided a $13M term loan to Aclima, a climate-tech company specializing in hyperlocal air pollution and GHG measurement and analysis technology, to support its growth in the national security sector. Read More

- Blume Equity LLP, a female-led growth climate-tech investor, secured British Patient Capital and Queensland Investment Corporation as LLPs, with BPC committing €25M to its Fund I to support European businesses addressing climate and environmental challenges. Read More

- Natural Resources Canada is investing $14.9 million in 20 projects to install over 3,000 EV charging stations nationwide, while also raising awareness and setting standards to support Canada’s transition to a net-zero future. Read More

Tech Spotlight

Hyzon Begins Production of 200kW Fuel Cell Electric Truck

Source: Hyzon Motors Press Release, September 2024

Overview:

Hyzon Motors has commenced production of its Class 8 200kW fuel cell electric truck (FCET), which is powered by hydrogen. The project is a collaboration with Fontaine Modification, based in North Carolina, marking the transition from prototype to series production at Hyzon’s Bolingbrook facility in the US.

Commercial Viability

Production Strategy:

Hyzon is supplying Fontaine Modification with kits for the fuel cell system, battery packs, and hydrogen storage systems. Fontaine will assemble these into vehicle chassis, having already confirmed that the necessary equipment, documentation, and processes are ready for series production.

Cost Efficiency:

The truck features a single-stack 200kW fuel cell system, which Hyzon claims is 25% more cost-efficient than using two 110kW systems. This innovation could reduce production costs and enhance commercial attractiveness.

Technical Viability

System Testing:

The 200kW fuel cell system underwent successful testing in 2023 at Hyzon’s Bolingbrook facility, validating the design, equipment, and operational processes. This validation is critical as the truck moves into full production and eventual commercialization.

Certification Milestone:

Hyzon expects to achieve ISO 9001 certification by Q4 2024, a significant milestone that could boost confidence in the product’s quality and manufacturing processes.

Environmental Viability

Emission Reduction:

The 200kW FCET is designed to serve hard-to-decarbonize heavy-duty industries, offering fleet operators a way to reduce emissions without sacrificing performance. The vehicle is positioned as a viable solution for industries aiming to meet stricter environmental regulations.

Scaling Potential

Series Production:

With the transition to series production, Hyzon’s collaboration with Fontaine Modification could accelerate the broader adoption of hydrogen fuel cell trucks. The successful launch of the 200kW FCET could pave the way for scaling up production and deployment across various heavy-duty applications.

Long-Term Implications

Industry Impact:

This production milestone represents a significant step towards mainstreaming hydrogen-powered vehicles in the heavy-duty sector. If successful, it could set a new standard for the industry, driving further advancements in fuel cell technology and contributing to global decarbonization efforts.

Challenges Ahead:

Despite these advancements, Hyzon faces financial challenges, including the risk of delisting from the Nasdaq stock exchange due to its low share price. This could impact its ability to attract investment and scale production in the future. Read More

Policy Pulse

This section includes global updates on climate change policy, governance and regulation.

CEZ is to develop small modular reactors with Rolls-Royce.

Czechia is set to deepen its involvement in the global nuclear energy supply chain through a strategic partnership between semi state-owned CEZ and Rolls-Royce, focusing on the development and production of small modular reactors, with plans for the first reactor at Temelin by the early 2030s.

Why it Matters: This partnership positions Czechia as a key player in the global nuclear energy industry, advancing its technological capabilities and energy security through local production of small modular reactors. Read More

Today’s Climate Data Point

Emerging Viability and Challenges of Carbon Removals: Wood Mackenzie Report Highlights Key Obstacles

Source: Wood Mackenzie, ‘Carbon removals: The ‘net’ in net zero’

A recent report by Wood Mackenzie underscores the crucial role of carbon removals in achieving net zero emissions but reveals significant challenges that could hinder progress. The study indicates that while carbon removals are becoming a viable investment opportunity, current efforts are insufficient to meet global net zero targets, largely due to technical and policy constraints.

Report Focus:

- Research Emphasis: The report highlights the importance of carbon removals in the energy transition, noting that eliminating CO2 emissions alone is exceptionally difficult. It advocates for a large-scale ramp-up of carbon removal projects to meet net zero goals.

- Key Findings:

- Investment Viability: Nature-based solutions, such as afforestation and soil carbon, present a lower-cost option compared to engineered solutions, which are currently more expensive. These nature-based approaches can be deployed at under $100 per tonne of CO2, whereas engineered solutions range from $100 to $1,000 per tonne.

- Geographic Potential: High-emission countries like the US, Brazil, China, Indonesia, and India have substantial land resources suitable for large-scale carbon removal projects.

- Market and Policy Challenges: The sector remains risky for investors due to inconsistent policy support globally. Governments’ involvement is crucial to stimulate both demand and investment in nature-based solutions.

Implications:

- Market Dynamics: Carbon markets are essential for monetizing carbon removals. The report highlights the need for clear carbon pricing mechanisms to translate emissions mitigation into financial value, emphasizing that companies and governments must be willing to pay for these removals.

- Government Role: Governments are urged to use their purchasing power and consider international trading to promote investment in carbon removal projects, especially in developing countries. Enhanced government support is vital for scaling up projects and achieving global equity.

Methodology:

- Demand Forecasting: The report projects that voluntary carbon market participants will demand over 1.7 billion tonnes of CO2 equivalent per year by 2050. This demand could more than triple with improved market integrity and verification processes.

- Cost and Technology Considerations: For technologies like Direct Air Capture, advancements in supply-chain optimization, energy consumption, and capture technologies are necessary to reduce costs and attract investment.

Future Directions:

- Policy and Market Development: To drive the necessary scale, governments must set national carbon removal targets and provide adequate incentives. There is also a call for further development of carbon markets and regulatory frameworks to support the growth of carbon removal projects.

Conclusion:

The report concludes that while nature-based solutions will contribute the majority of carbon removals in the base case, engineered solutions are crucial for achieving gigatonne-scale impacts. Immediate, coordinated actions and supportive policies are essential to unlock the full potential of carbon removals and help meet global climate goals.

In Other News

This section covers notable news highlights in climate tech.

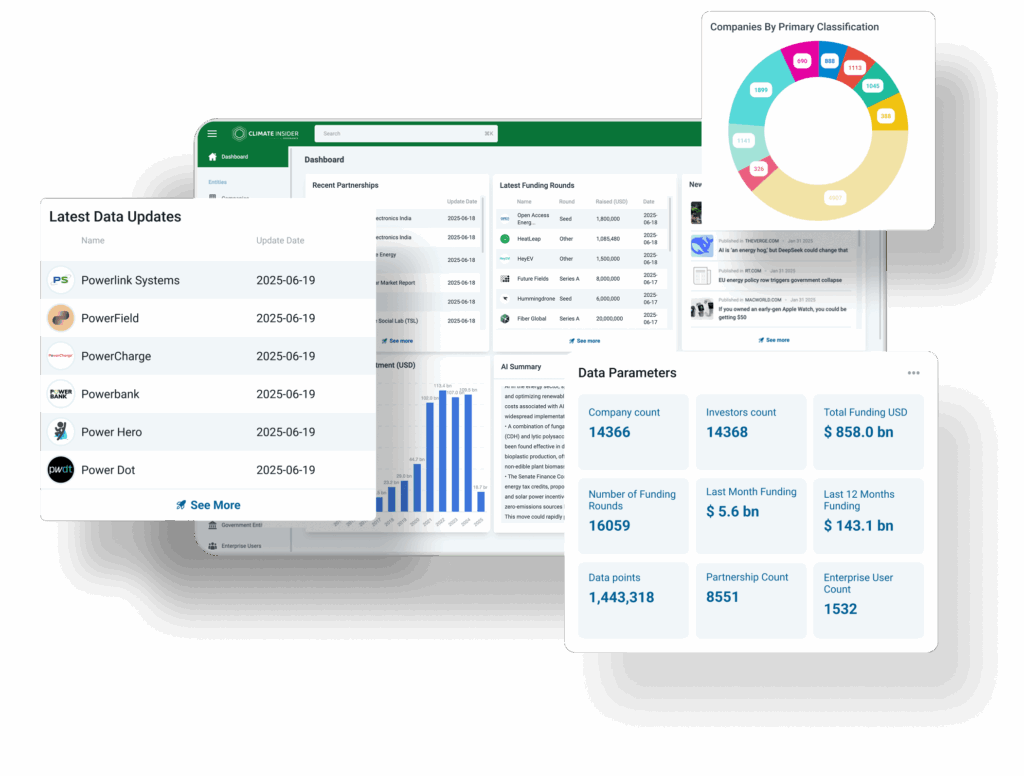

- Climate Insider has partnered with 🌏 The Atlas Capital & Climate Tech Coalition to cover The Climate Tech Investors Summit in New York City on September 24-25, 2024, an event focusing on funding and advancing climate solutions through discussions and networking with industry leaders and investors. Learn More

- Frontier has brokered $4.5 million in carbon removal prepurchases from nine companies for buyers including Stripe, Shopify, Alphabet, H&M Group, and Match, facilitated through Watershed. Read More

Climate Insider Intelligence: The Rise in Net Zero Commitments Among Global Giants – Insights from the Climate Impact Partners Report

Amidst a tumultuous global backdrop of economic uncertainty and skepticism towards Environmental, Social, and Governance (ESG) frameworks, a compelling trend is emerging: a notable surge in net zero commitments among the world’s largest corporations. According to the latest Climate Impact Partners study, a striking 45% of Fortune Global 500 companies now aim for net zero by 2050, a substantial increase from 39% last year and a remarkable leap from a mere 8% in 2020. This silent yet steady rise in corporate climate ambition defies external pressures, signaling a growing recognition that long-term business viability hinges on integrating climate goals into core strategies. This article delves into the nuances of this shift, exploring regional differences, the strategic role of carbon credits, and the broader implications for global climate action. Read More