Welcome to Climate Tech Pulse, your daily source of market intelligence for businesses and investors navigating the rapidly evolving landscape of climate tech solutions. From groundbreaking investments to breakthrough innovations cutting-edge, we’re bringing you the top stories on climate tech that are shaping collective futures.

Don’t miss out on tomorrow’s climate solutions – subscribe now to stay ahead of the curve! https://lnkd.in/dwr7B9XJ

Today’s Highlights:

🔝Top Story: Climate Investment Funds’ Inaugural $500M Bond Issuance Completed with Citi as Key Partner.

💲Investment: The GEF’s $20M grant boosts climate resilience in Bhutan, while Project Eaden, Cancrie, and SolidWatts secure funding for sustainable tech advancements.

🔬 Innovation: Colorado State University received $326 million to research methane emissions reduction and improve oil and gas operations.

🔄 Integration: Odata, Mongolia, and Siemens eMobility are advancing renewable energy and electrification projects in Chile, Mongolia, and Tuscany, respectively.

💡 Intelligence: Early 2025 Climate Tech Funding Highlights.

Climate Investment Funds’ Inaugural $500M Bond Issuance Completed with Citi as Key Partner

Image Credit: CIF

CCMM’s First Bond Issuance Raises $500 Million

The Climate Investment Funds (CIF) Capital Market Mechanism (CCMM) has completed its inaugural bond issuance, raising $500 million through a 3-year bond. Proceeds from the issuance will support the Clean Technology Fund (CTF), scaling up low-carbon technologies across renewable energy, energy efficiency, and clean transport in low- and middle-income countries. CCMM’s borrowing program, launched in November 2024, represents a major step toward mobilizing private capital for climate action.

Citi’s Role in Driving Global Capital Access

Citi played a pivotal role in the issuance, serving as Note Trustee, Principal Paying Agent, and Calculation Agent for the CCMM borrowing program. Dirk Jones, Head of Issuer Services at Citi, highlighted the bank’s global network and cross-border expertise in facilitating capital raising initiatives. This partnership underscores Citi’s commitment to supporting international climate finance through innovative mechanisms.

A Global Framework for Clean Technology Financing

Established in July 2024, CCMM leverages its AA+ and Aa1 ratings from Fitch and Moody’s to raise private capital via international markets. Funds are deployed through six multilateral development banks, including the World Bank, which acts as the CTF Trustee and Treasury Manager. These efforts aim to accelerate the adoption of clean technologies in critical sectors, aligning with global sustainability goals. Read More

Investment Highlights of the Day

- The GEF’s USD 20M grant aids climate resilience in Bhutan’s Thimphu-Paro region amid declining funds post-LDC graduation. Read More

- Project Eaden raised €15M in a Series A round led by Planet A and REWE Group to advance its plant-based meat technology. Read More

- Cancrie raised $1.2M to scale its sustainable nanocarbon materials for advanced energy storage solutions. Read More

- SolidWatts raised €850k to advance its Radio Frequency industrial heating solution for sustainable industries. Read More

Innovation Highlights of the Day

Colorado State University received $326 million to research methane emissions reduction and improve oil and gas operations. Read More

Integration Highlights of the Day

- Brazil’s Odata has contracted Atlas Renewable Energy to supply solar power to its Chilean datacenters through a traditional power purchase agreement. Read More

- Mongolia is partnering with the EBRD to develop renewable energy projects, aiming for 300MW of solar, 200MW of wind, and energy storage by 2028. Read More

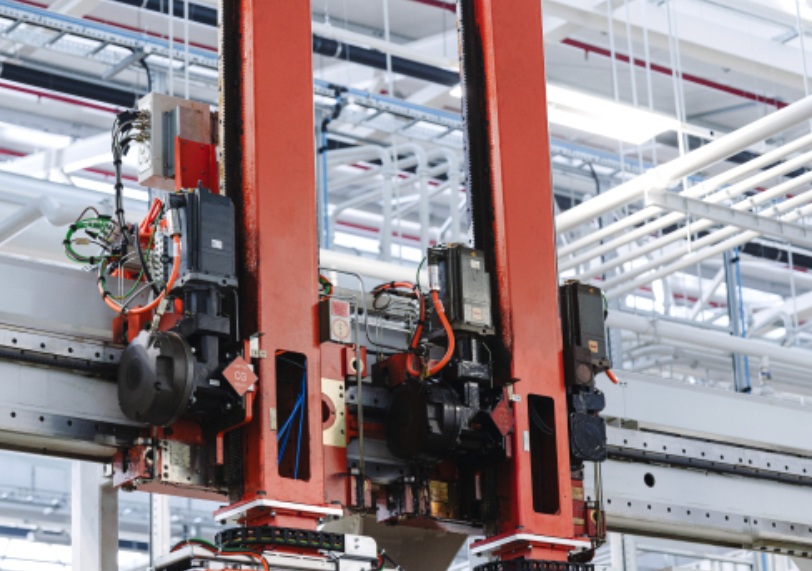

- Siemens eMobility is partnering with Autolinee Toscane to electrify bus depots in Tuscany, supporting the deployment of a zero-emission bus fleet with 73 fast-charging points. Read More

Climate Insider Intelligence: Early 2025 Climate Tech Funding Highlights

As we step into 2025, climate tech and clean energy sectors are seeing an influx of major investments. From DeepGreenX Group Inc.’s $25 billion commitment to advancing clean energy, to Sunfire’s €200 million raise for hydrogen production, the momentum is palpable. With players like Electra, Inari, and Moonrider.ai securing millions to transform industries, this wave of funding highlights the growing investor confidence in sustainable innovations. In our latest article, we break down the top funding rounds, key sectors driving growth, and what this means for the future of climate action. Don’t miss out—read more about how capital is accelerating the race to net zero. Read More