Insider Brief

- Governments worldwide are assessing the economic feasibility of nuclear power versus renewables, with costs and subsidies playing a key role in shaping energy policy.

- Renewables like solar and wind are becoming significantly cheaper, with Levelized Cost of Electricity (LCOE) projections showing continued declines, while nuclear faces persistent cost overruns and delays.

- Government support for renewables is rising, while nuclear funding has declined, particularly in regions like the Caribbean, where infrastructure and financial challenges limit nuclear adoption.

The future of energy is being shaped by cost, policy and technology. As governments weigh nuclear power against renewables such as solar and wind, economic feasibility is a driving force behind policy decisions, writes Dianne Plummer in Forbes.

Cost Comparisons: Nuclear vs. Renewables

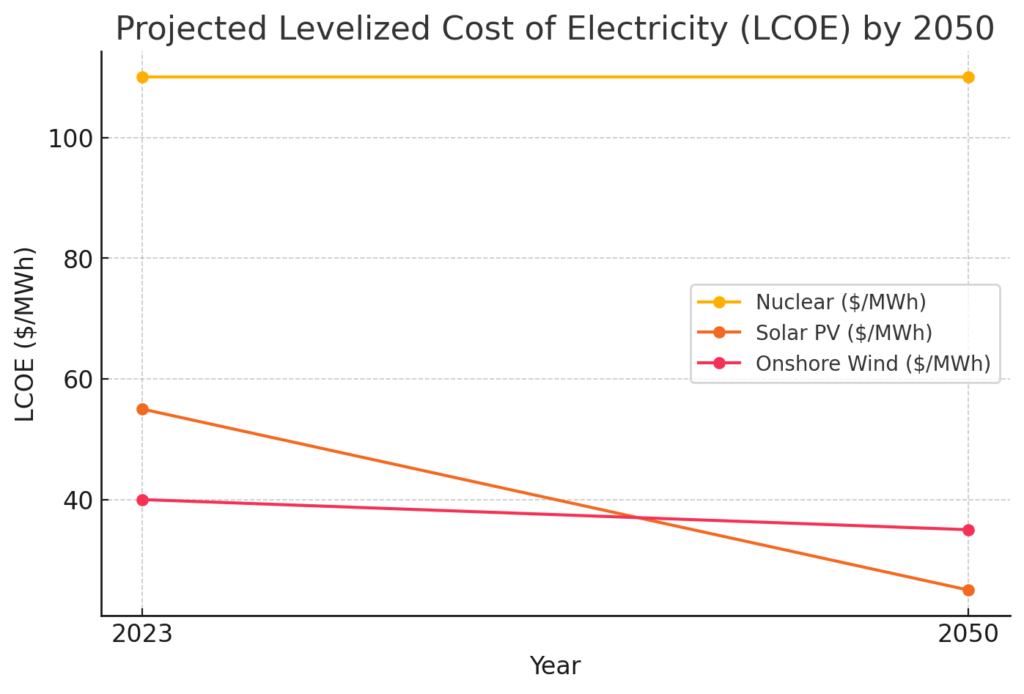

A key metric in energy economics is the Levelized Cost of Electricity (LCOE), which measures the total cost of building and operating a power plant over its lifetime, expressed in dollars per megawatt-hour. Plummer, citing the U.S. Energy Information Administration, writes that nuclear power had an estimated LCOE of $110/MWh in 2023, a figure projected to remain constant through 2050. In contrast, solar photovoltaic (PV) stood at $55/MWh in 2023, expected to decline to $25/MWh by 2050. Onshore wind was at $40/MWh in 2023, with projections of $35/MWh by 2050, making renewables significantly cheaper in many cases.

This trend is not limited to the U.S. The 2023 Renewable Power Generation Costs report indicated that globally, the LCOE for utility-scale solar PV declined by 12% from 2022. Onshore wind dropped by 3%, and offshore wind fell by 7%. Battery storage saw the most significant decrease, with an 89% reduction in cost from 2010 to 2023.

Nuclear energy, meanwhile, faces persistent cost overruns and delays. The 2023 World Nuclear Industry Status Report found that 58 nuclear reactors were under construction worldwide, with many delayed. In 10 of the 16 countries building new reactors, all projects faced significant setbacks, according to Plummer, who is the lead consultant for STEM Sparks Solutions. The Hinkley Point C nuclear plant in the UK, initially estimated to cost £16 billion, has ballooned to £34 billion, with an expected operational date now pushed beyond 2030.

Government Subsidies and Investment Trends

Government subsidies continue to influence energy markets, according to Plummer. Nuclear research and development has seen a decline in funding since the 1970s. In 2015, the International Energy Agency reported that nuclear technologies received 20% of the public energy R&D budget, down from nearly 73% in 1975. Meanwhile, funding for renewables and energy efficiency has grown significantly.

A 2017 report on global energy subsidies showed that of the $634 billion in subsidies that year, fossil fuels accounted for 70%, renewables for 20%, biofuels for 6%, and nuclear for just 3%, writes Plummer. However, projections suggest that total subsidies will decline to $466 billion annually by 2030, with renewable subsidies accelerating and nuclear remaining a minor recipient of government support.

In the U.S., the Inflation Reduction Act of 2022 has incentivized investments in wind and solar projects through tax credits. China remains the global leader in renewable energy investments, allocating $546 billion in 2022, according to Scientific American.

The Caribbean Context

The Caribbean faces unique challenges in its energy transition, writes Plummer. While many nations in the region aim to increase renewable capacity, the isolated nature of island grids and limited land for large-scale solar or wind farms make achieving economies of scale difficult. According to the International Renewable Energy Agency (IRENA), Caribbean nations have set a regional target of 47% renewable electricity generation by 2027, requiring an estimated $9 billion in investment.

Jamaica has explored nuclear energy as part of its energy strategy, signing agreements with Canadian nuclear agencies.

However, as Plummer writes in Forbes: “However, “introducing nuclear power in Jamaica’s energy mix is unlikely to significantly improve energy security due to the high costs, long lead times, and reliance on foreign expertise and resources for nuclear technology. Additionally, the raw materials required for nuclear power plants, such as uranium, would still need to be imported, further limiting the potential for true energy independence.”

Balancing Nuclear and Renewables for the Future

As the global energy landscape shifts, the debate between nuclear power and renewables remains complex. Nuclear energy offers reliable, low-carbon baseload power but is hindered by long construction timelines, cost overruns, and waste disposal challenges. Renewables, on the other hand, are experiencing falling costs and rapid deployment, though they require significant investment in storage and infrastructure to address intermittency.

In regions like the Caribbean, nuclear remains financially and logistically impractical, while renewables face geographical limitations. Policymakers must weigh economic feasibility, policy support, and technological advancements to determine the optimal energy mix. The future of energy will be shaped by investments in innovation, grid resilience, and infrastructure—all of which will determine whether nuclear or renewables will dominate the decades ahead.

“Ultimately, the choice between nuclear and renewables hinges on economic feasibility, policy support, and technological advancements, and requires a balanced approach to ensure a sustainable and resilient energy future,” writes Plummer.