Insider Briefs

- Offshore wind vessel operator Havfram will be acquired by Belgium-based DEME in a €900 million deal expected to close by the end of April 2025.

- Havfram was established in 2021 through a partnership between Sandbrook Capital and PSP Investments to meet the growing need for advanced Wind Turbine Installation Vessels (WTIVs) amid booming offshore wind development.

- With two next-generation vessels under construction and a strong contract backlog, Havfram’s acquisition marks a strategic expansion for DEME and a successful exit for Sandbrook and PSP Investments, who cited strong financial returns and alignment with clean energy goals.

Sandbrook Capital and PSP Investments Reflect on Havfram’s Growth

PRESS RELEASE – Sandbrook Capital, a private investment firm focused on building leading climate infrastructure companies, and the Public Sector Pension Investment Board (PSP Investments), one of Canada’s largest pension investors, announced the signing of an agreement to sell Havfram, an international offshore wind infrastructure company, to DEME (Euronext: DEME), a global leader in offshore energy and marine engineering.

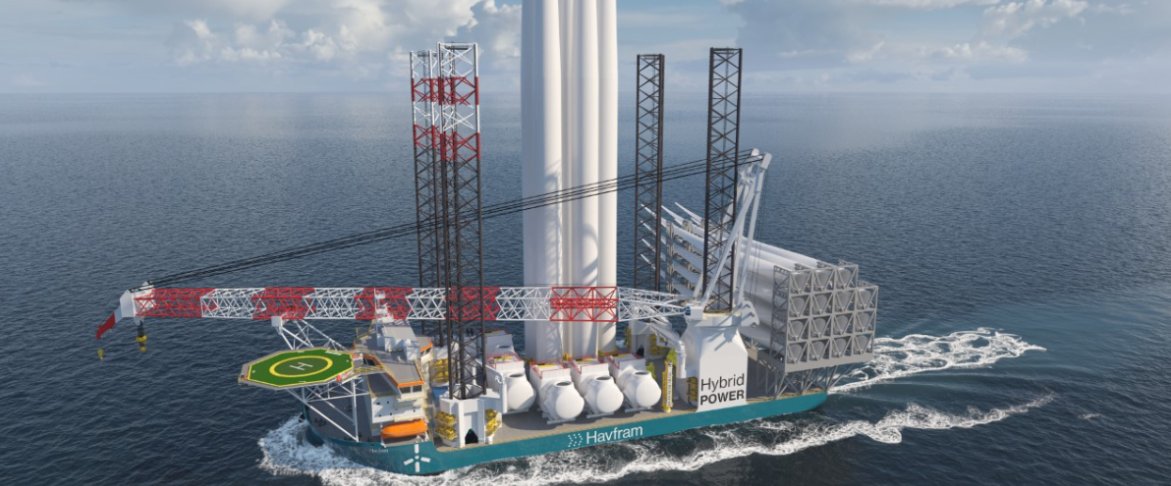

Established in 2021 through a strategic partnership between Sandbrook and PSP Investments, Havfram was created to provide critical offshore wind installation capacity to the world’s leading energy companies. Under their ownership, Havfram has evolved into a world-class operator of Wind Turbine Installation Vessels (WTIVs), with two state-of-the-art vessels currently under construction and a strong contract backlog to build some of the largest offshore wind farms.

“We partnered with PSP to build Havfram because we saw a unique market opportunity to provide the state-of-the-art vessels required to build today’s enormous offshore wind farms” said Christopher Hunt, Partner at Sandbrook Capital. “In just a few years, Havfram has become one of the most important players in the offshore wind industry. We are proud of what the team has achieved and the positive financial returns delivered to our investors. DEME will be an outstanding steward of the company in its next phase of growth.”

DEME’s Acquisition to Accelerate Offshore Wind Deployment

“Our investment in Havfram reflects our broader capabilities and commitment to invest in assets essential to the renewables value chain, while generating strong risk-adjusted returns,” said Sandiren Curthan, Managing Director and Global Head of Infrastructure Investments, PSP Investments. “We are proud to have partnered with Sandbrook and with the Havfram team to build a fleet of next generation WTIVs.”

“The support and long-term vision of Sandbrook and PSP have been instrumental in building Havfram into what it is today,” said Ingrid Due-Gundersen, CEO of Havfram. “We’re incredibly excited to join forces with DEME, a global leader with a shared mission to accelerate offshore wind deployment. Together, we will play a major role in enabling the energy transition around the world.”

Transaction Details and Advisors

The transaction, valued at approximately €900 million, is expected to close by the end of April 2025, subject to customary closing conditions.

Goldman Sachs served as financial advisors and Thommessen served as legal advisor to Sandbrook Capital and PSP Investments.