Insider Brief

- Dow has delayed its $10 billion Path2Zero project in Fort Saskatchewan, Alberta, due to unfavorable market conditions and macroeconomic headwinds.

- Construction of the net-zero ethylene cracker and derivatives facility was originally planned to begin in 2024 with operations starting in 2027, but will now be postponed until market fundamentals improve.

- The delay is part of Dow’s broader cost management strategy, including reducing 2025 capital expenditures from $3.5 billion to $2.5 billion, generating $6 billion in liquidity, and selling select U.S. Gulf Coast assets to Macquarie Asset Management for $2.4 billion.

Dow Inc. has delayed construction on its flagship Fort Saskatchewan Path2Zero project, citing weak market conditions and macroeconomic headwinds.

The nearly $10 billion project, which the company touted would be the world’s first net-zero Scope 1 and 2 emissions ethylene cracker and derivatives facility, was originally to start construction in 2024 and ramp up production in 2027. Dow executives announced the delay in the company’s first-quarter earnings release on April 24, 2025, noting that construction will be paused until “market conditions improve.”

The company indicated it will save it $1 billion in capital expenditures as it plans to cut total enterprise capital expenditures to $2.5 billion in 2025, down from its previous guidance of $3.5 billion.

The decision reflects broader economic pressures weighing on the chemical giant. Dow reported a first-quarter net loss of $290 million and operating EBIT of $230 million, down $444 million from a year earlier. Cash provided by operating activities dropped to $104 million, compared to $460 million a year ago, driven by weaker global demand and higher energy and feedstock costs, according to the company.

“The significant impact of slower GDP growth and volatile market conditions on our industry underscores the importance of our proactive management,” said Dow Chairman and CEO Jim Fitterling.

Dow emphasized that it remains committed to the Path2Zero project and sees strong future upside from targeted applications such as pressure pipe, wire and cable, and food packaging. The Alberta-based facility is being developed at an existing Dow site, offering cost advantages and high return potential.

The delay is part of a broader cash management strategy designed to generate approximately $6 billion in liquidity through a mix of asset sales, legal settlements, cost cuts, and reduced capital spending. Other moves include selling a minority stake in select U.S. Gulf Coast infrastructure assets to Macquarie Asset Management for $2.4 billion, targeting $1 billion in cost savings by 2026, and finalizing the collection of a $1 billion settlement from a judgment against Nova Chemicals.

Beyond Path2Zero, Dow is also expanding a review of its European assets, a move reflecting ongoing challenges in the region. The company identified three upstream assets likely to face shutdown or idling: an ethylene cracker in Böhlen, Germany; chlor-alkali and vinyl assets in Schkopau, Germany; and a basics siloxanes plant in Barry, U.K.

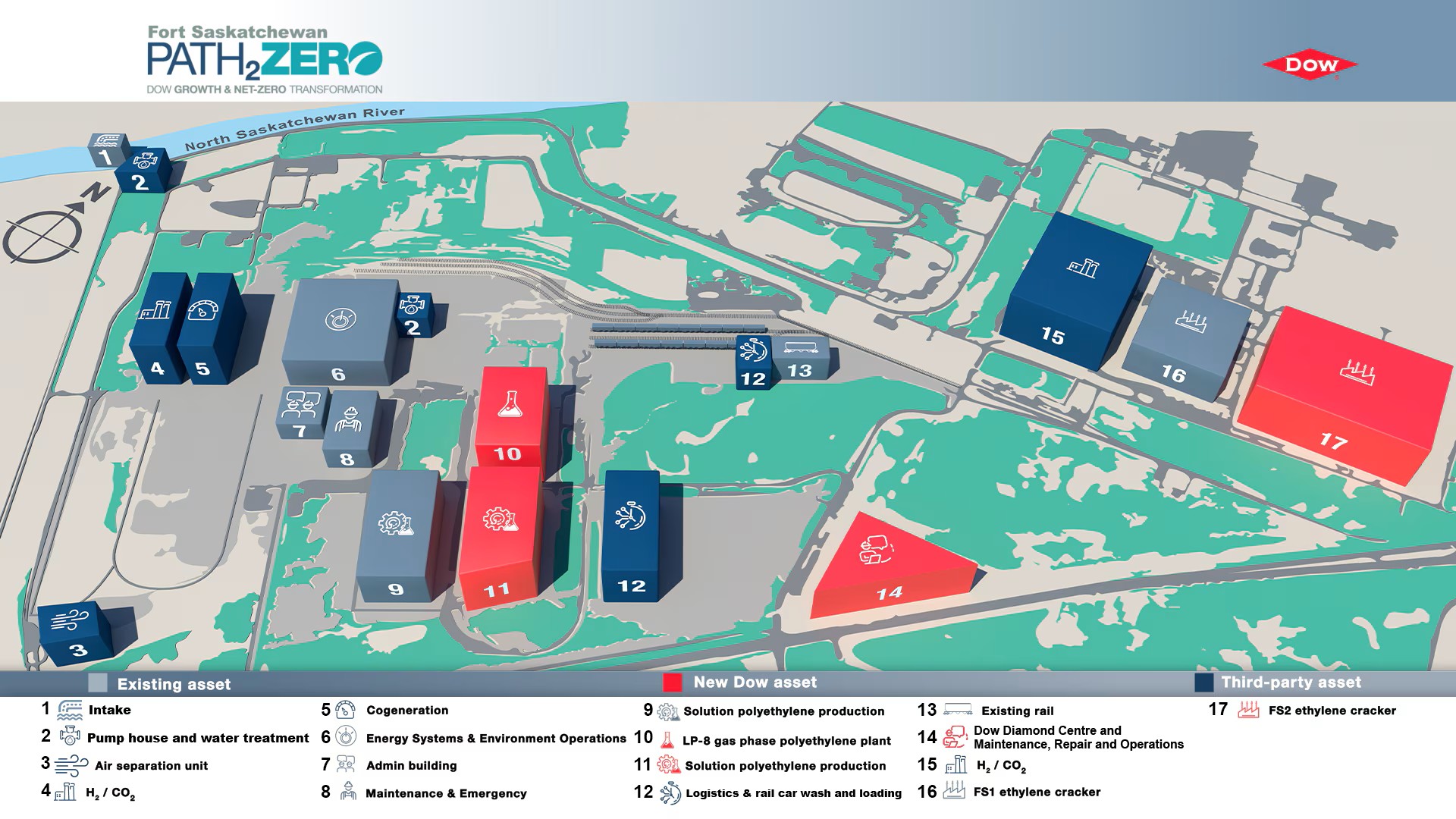

According to Dow, the Alberta Path2Zero Project, to be built at an existing Dow site in Fort Saskatchewan, was planned to include:

- Include a brownfield expansion and retrofit of Dow’s existing manufacturing site in Fort Saskatchewan.

- Decarbonize approximately 20 percent of Dow’s global ethylene capacity while growing polyethylene supply by about 15 percent.

- Triple Dow’s ethylene and polyethylene capacity from the site, while retrofitting the site’s existing assets to net-zero carbon emissions.

- Add approximately 1.8 million metric tons of ethylene capacity in a phased manner through 2030.

- Create approximately 4,500-5,500 jobs during peak construction and approximately 400-500 full-time jobs once operational.

- Produce and supply approximately 3.2 million metric tons of certified low- to zero-carbon emissions polyethylene and ethylene derivatives for customers and joint venture partners around the globe.

- Build on Dow’s strong leadership position and allow us to meet the increasing needs of customers and brand owners seeking to lower the carbon footprint of their products.

- Reduce net annual carbon emissions by an additional 15 percent, and net annual carbon emissions by approximately 30 percent by 2030 (since 2005).

The Path2Zero delay comes at a time of increased scrutiny on capital allocation across the chemical industry, with executives balancing long-term decarbonization ambitions against near-term financial discipline.

Dow’s Path2Zero facility was a centerpiece of its sustainability strategy and was expected to demonstrate a scalable model for low-carbon petrochemical production. While the delay is a setback, the company stressed that construction will resume once market fundamentals become more favorable.

As reported by the CBC, The Alberta Petrochemicals Incentive Program committed about $1.8 billion to the project as well as $400 million from Canada’s carbon capture tax credit and clean hydrogen investment tax credit.

A spokesperson for Energy and Minerals Minister Brian Jean said in a statement to the CBC that Dow still considering the Path2Zero a “key corporate priority” as encouraging.

“This project is very important for Alberta and our economy, and for proving that Alberta is the best place in the world to build low-emissions energy and petrochemical projects,” the government statement noted, according to the CBC.