Insider Brief:

- U.S. private equity firm Ara has raised US$800 million to reduce carbon emissions in the industrial sector.

- Ara had initially targeted US$500 million, drawing strong support from existing investors as well as new investors, including pension funds, insurance companies, sovereign wealth funds, endowments, and foundations from North America, Europe, and the Asia-Pacific region.

- The fund now owns 12 operational assets from across North America and Europe.

PRESS RELEASE: Ara Partners, a global investment firm dedicated to the decarbonization of the industrial economy, today announced that it has raised over $800 million for its Ara Infrastructure strategy, including its debut Fund, Ara Infrastructure Fund I, and associated co-investment vehicles. The Fund exceeded its target of $500 million, drawing strong support from Ara’s existing investor base and a diverse set of new institutional investors comprised of pension funds, insurance companies, sovereign wealth funds, endowments, and foundations from North America, Europe, and the Asia-Pacific region.

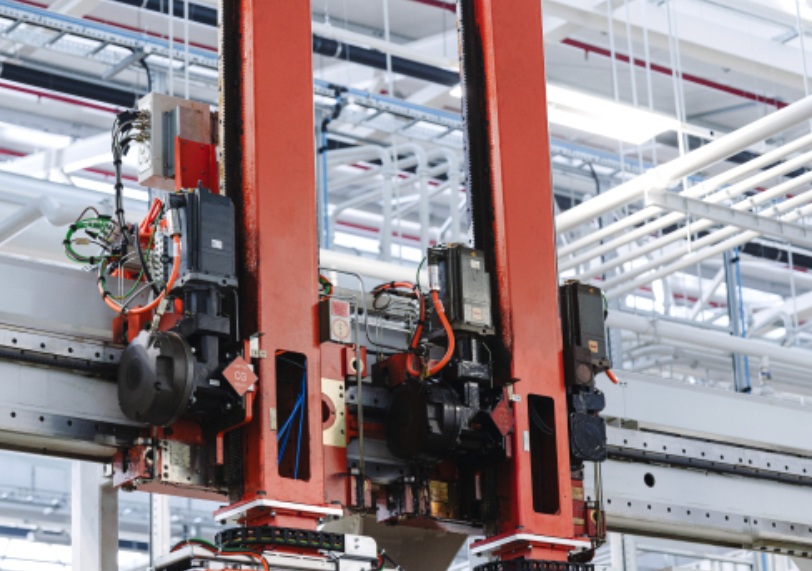

Ara Infrastructure is led by industry veterans George Yong and Teresa O’Flynn. The strategy targets mid-market infrastructure with a focus on developing new and re-purposing high quality legacy assets for the low carbon industrial economy. Since launching the strategy in 2022, Ara Infrastructure has completed three investments, with a fourth commitment expected shortly. The Fund now owns 12 operational assets across North America and Europe. Portfolio companies include:

Lincoln, a leading terminal services provider with a strong footprint in the Southeastern and Mid-Atlantic U.S.;

USD Clean Fuels, a developer of renewable fuel feedstock and biofuel logistics infrastructure on the U.S. West Coast;

Natural World Products, a leading organics recycler in Northern Ireland and the Republic of Ireland, managing over 330,000 tonnes of household waste annually.

“We are incredibly proud of this milestone and grateful for the robust support from our investors. This Fund enables us to pursue a generational investment opportunity across Europe and North America, characterized by increasing energy and industrial demand, a move towards decentralized energy systems, as well as the need to ensure an economic path toward a lower carbon economy,” said Teresa O’Flynn, Partner and Co-Head of Infrastructure at Ara Partners. “We are focused on building high-value decarbonization assets that future-proof businesses for the modern economy and support the energy transition.’’

“We are committed to delivering attractive risk-adjusted returns with classic infrastructure characteristics to our investors,” said George Yong, Partner and Co-Head of Infrastructure. “Ara’s builder capabilities and DNA ideally position us to navigate the disjointed, yet opportunity-rich, world of middle-market sustainable infrastructure. Companies in our target sectors seek more than just a capital provider; we believe our in-house operational capabilities make us a value-add partner of choice. We look forward to supporting exceptional teams and companies across these sectors.”

Rede Partners acted as placement agent and Debevoise & Plimpton LLP served as legal counsel in the formation of Ara Infrastructure Fund I.