Insider Brief:

- Coreshell has developed an anode that relies on silicon, not the graphite that is widely used.

- The company’s innovation solves problems presented by cost, resource scarcity, and political pressures, the co-founder and CEO said.

- Climate tech needs to embrace a more ‘mass market’ positioning instead of expecting consumers to pay a premium, he said.

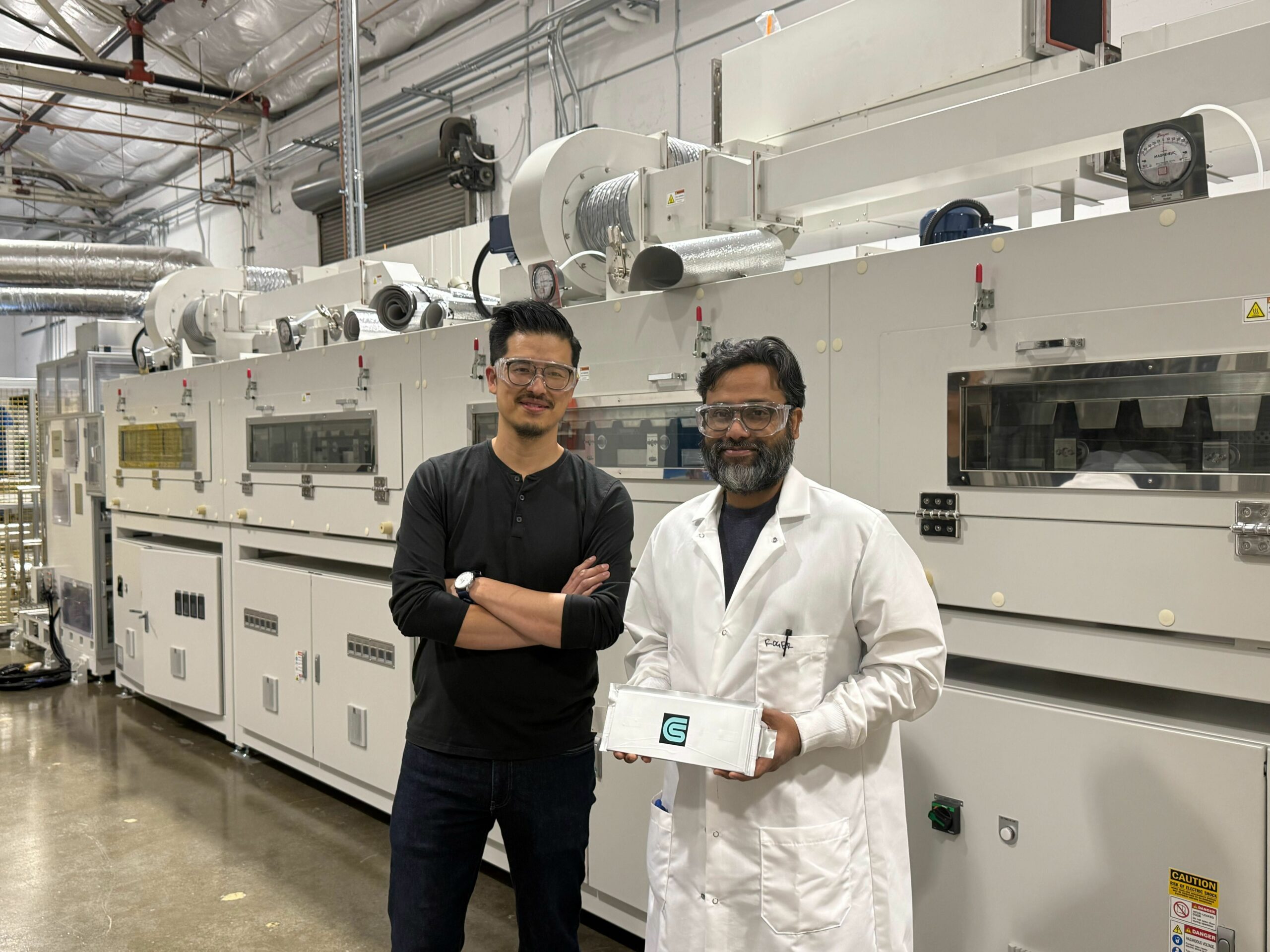

For Coreshell co-founder and CEO Jonathan Tan, the global battery industry is contending with several different pressures.

Companies are facing growing demands for decarbonization of products and processes. There is also a supply crunch of valuable materials from China, as well as increasing demand by the new American presidential administration for American companies to source their supplies from domestic producers.

The Coreshell technology for battery anodes satisfies all three of these conditions, Tan told Climate Insider.

Coreshell’s technology produces anodes made from silicon, not graphite, as is usually found in electric vehicle batteries, Tan said.

The metallurgical silicon will be used in a new battery design pioneered by Coreshell and launched in March 2025. The new battery cell design added at least 30% more range while lowering cost of the battery by at least 25%, Tan said.

The metallurgical silicon battery cells provide a battery density that are 30% to 40% higher than graphite cells, Tan said, which allows EVs to have a longer range while also having a lighter battery.

Also, by replacing silicon with graphite, the material is now fully free of fossil fuels.

“People don’t realize that synthetic graphite [a component of many electric battery anodes] is the predominant anode choice. There is some natural graphite in this ingredient, but it’s a lot more synthetic. And synthetic graphite uses fossil fuels” in its production, Tan said.

It also solves the resource scarcity question.

“Ninety-five percent of the graphite is produced in China right now,” he said. “That reliance is a huge risk. So we’re replacing it with metallurgical silicon, at low cost, that’s produced globally and domestically in the U.S., where hundreds of thousands of tons have been produced already.”

In March 2024, California-based Coreshell reached an agreement with London-based silicon metal producer Ferroglobe for silicon supplies. Ferroglobe has silicon smelters in Ohio and in Alabama.

“Our partnership is about taking their already-developed assets, which are producing hundreds of thousands of tons of silicon, and using it to take care of this really challenging supply chain problem,” Tan said.

The push for more domestic development of goods in the U.S. is not unique to current U.S. Donald Trump, Tan said.

“If you go back and look at previous administrations, this is a common theme: everyone was pushing for the domestication of these materials,” he said.

Joe Biden had similar a similar policy, “but the decisions and mechanisms are different – those came via the Inflation Reduction Act and incentives,” Tan said.

Climate tech moving into new phase

Disruptions in the electric vehicle market can be applied to a larger shift in the climate tech industry, Tan said.

“If you compare climate tech to where it was 20 years ago, there’s a lot more funding available, and more of an ecosystem built up for climate-related investments,” he said. Even if there does seem to be more ups and downs, the macro trend is that there’s more investment and capital available for the sector than ever before.

“We’re moving past ‘early adoption’ and into a ‘mass market’ curve,” he said, adding that climate tech and EV companies can no longer expect consumers to pay extra for the environmental premium these products include.

Coreshell’s technology expands the potential customer base of EV buyers by bringing costs of the vehicle down, Tan said.

Even though new technologies need to embrace the ‘mass market’ approach, companies will still need to educate investors and interested companies about their products, he said.

When Coreshell was approaching investors about its silicon anode, it needed to differentiate itself from luxury car brands which were moving into silicon.

“We had to demonstrate that if you look at the commodity pricing of silicon, it costs less than graphite on a ‘per kilogram’ process, so we can use 10 times less of it to make the same size battery, and it holds the same amount of energy,” Tan said.

What Coreshell offers is “completely different” to the other luxury car market, and it has a different value proposition: expanding the range while also having a less expensive battery, he said.

Tan not concerned about the perceived decline in EV sales in many markets.

“To me, there’s no concern about the market slowing down,” he said. “If you look at the numbers, it paints a different picture. Globally they’ve gone up, and the only thing that’s slowed down is the slope. The rate [of EV sales] has increased, but not as fast as some people projected in its heyday.”

Climate Insider equips green economy businesses, industrial leaders, and policymakers with the clarity they need to navigate environmental demands and geopolitical pressures. Through our AI-powered market intelligence platform and expert-led advisory, users can identify commercially ready climate technologies, track policy and funding movements, and map critical ecosystem dynamics.

Ready to take the guesswork out of your climate strategy?

Get expert-backed answers at [email protected] or explore the platform at www.climateinsider.com to see how we help transform complexity into clarity.