Small Modular Reactors (SMRs) are moving from concept to deployment in 2025, with analysts projecting a $300 billion global market by 2040. A new report from Climate Insider outlines how this class of compact nuclear reactors is positioned to deliver zero-carbon energy to industries and power grids – and offers a roadmap for businesses navigating the next decade of commercialization.

Click here to download the full version of the report.

The report, Small Modular Reactors: Assessing the Commercial Readiness, Market Pathways, and Implementation Opportunities for Industrial Stakeholders, evaluates the current status of SMRs across technical, policy, market, and organizational dimensions. Its findings highlight both the opportunities and risks facing industrial users, utilities, and governments investing in the technology.

Market Opportunity and Emissions Impact

Climate Insider estimates that SMRs, if deployed at scale — roughly 21 gigawatts of electric capacity by 2035 — could eliminate up to 15 gigatons of CO₂ by mid-century. For perspective, that is almost half of annual global emissions: The world emitted about 37 Gt of CO₂ in 2023. A 15 Gt reduction equals about 40% of one year’s global output.

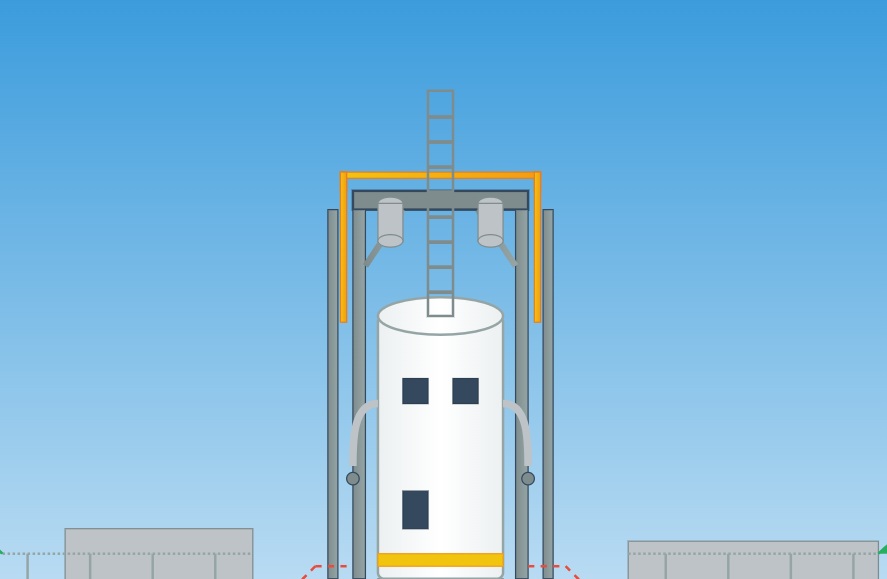

The reactors are designed to replace fossil fuels in hard-to-decarbonize sectors, such as industrial heating and distributed power for data centers, ports and remote communities. Their smaller footprint and modular construction also enable deployment in urban areas or as add-ons to existing infrastructure.

The value proposition spans more than just emissions reductions. SMRs promise greater energy security by offering stable, high-temperature power independent of weather or fuel imports. They can help stabilize grids that rely heavily on variable renewables and, if deployed in fleets, could reduce long-term operating costs through standardization and shared resources.

SMR Deployment Milestones and Leading Designs

The report details that SMR deployments are already underway. China’s Linglong One SMR is expected to become operational this year. In North America, the Tennessee Valley Authority plans to deploy GE Hitachi’s BWRX-300 reactor at its Clinch River site, while Canada is preparing its Darlington facility for the same model. The United Kingdom is advancing four Westinghouse AP300 reactors as part of its first SMR project.

Climate Insider charts a global roadmap from first deployments in 2025 to full-scale commercial integration by 2035. Europe, North America, and Asia are all advancing projects, bolstered by regulatory approvals, public financing, and industrial partnerships.

One standout is NuScale Power, which became the first SMR developer to receive design approval from the U.S. Nuclear Regulatory Commission. NuScale has secured international deployment deals in Romania and Ghana and formed manufacturing partnerships with Doosan Enerbility and Sargent & Lundy.

Other key players include GE Hitachi, Rolls-Royce, X-energy, TerraPower, and Terrestrial Energy, each with different reactor designs and target markets. GE Hitachi leverages legacy boiling water reactor technology for faster deployment, while TerraPower’s Natrium system combines nuclear heat with molten salt energy storage. X-energy’s high-temperature gas reactor aims to serve industrial heat users but still faces fuel qualification hurdles.

Commercial Readiness: A Four-Part Framework

To assess viability, the report uses a “Four-Dimensional Readiness Framework” encompassing:

- Technical Readiness: Includes safety validation, fuel qualification, and component testing.

- Market Readiness: Looks at supply chain maturity, project cost competitiveness, and customer ecosystems.

- Policy Readiness: Reviews licensing processes, incentives, and stakeholder engagement.

- Organizational Readiness: Gauges developer capabilities, partnerships, and risk management strategies.

Climate Insider finds that few SMR developers currently score high across all four categories. NuScale and GE Hitachi lead in technical and regulatory preparedness, while companies like TerraPower and X-energy demonstrate innovation but need further development and supply chain alignment.

Financing and Policy Tools

SMR projects rely heavily on early-stage public support. First-of-a-kind deployments often require a mix of government loans, grants, and tax credits. For example, in Canada, the Infrastructure Bank committed $970 million to the Darlington BWRX-300, while the U.S. offers production tax credits and cost-sharing programs under the Inflation Reduction Act.

But the report warns that longer-term financing mechanisms — such as offtake agreements and pricing signals — are still lacking. Without these, repeat builds may struggle to attract private capital.

Climate Insider points to “learning curve” cost reductions as key to future competitiveness. Initial projects are expected to be costly, but prices should fall as designs are standardized, supply chains mature, and developers gain experience.

Deployment Pathways and Archetypes

The report outlines five deployment archetypes for SMRs, ranging from utility-scale grid projects to microreactors for remote mining or defense installations. Each archetype presents different technical requirements and regulatory complexities.

For instance, microreactors targeting off-grid applications may benefit from fast-track licensing, but face unique logistical challenges. Meanwhile, large-scale utility reactors must integrate with national energy plans and prove competitive with other clean energy sources like solar, wind, and hydrogen.

The U.S., Canada and the U.K. are highlighted as having the most advanced regulatory systems for SMRs, offering transparent licensing frameworks and technology-neutral policies. Canada’s Vendor Design Review process is singled out for enabling early-stage regulatory feedback that accelerates development while maintaining safety.

Organizational Readiness and Strategic Partnerships

The report argues that commercial success depends not only on technology but on coordination across stakeholders. Developers need robust supply chains, stable financing, and end-users with nuclear project management experience.

Partnerships are emerging across the SMR ecosystem. Amazon has backed X-energy for data center power, while Siemens is supplying components to Rolls-Royce. NuScale has aligned with Samsung C&T for global deployment, and Framatome has joined with Ultra Safe Nuclear Corporation in a fuel-focused joint venture.

These alliances help mitigate development risk and align technical innovation with business needs. However, organizational readiness remains uneven, especially for newer entrants without established nuclear experience or long-term capital.

Strategic Recommendations

Climate Insider closes the report with strategic recommendations for governments and industrial players considering SMRs.

For more information, or to connect with our analysts, contact us directly at [email protected]